10 retail trends of 2019 that you need to know

Retail

309 week ago — 13 min read

India’s retail industry is one of the fastest growing in the world. India is the world’s fourth largest retail market and is expected to grow from USD 795 billion in 2017 to USD 1.2 trillion by 2021.

‘Unravelling the Indian consumer’, a report by Deloitte and Retailers Association of India (RAI) sheds light on the trends defining the Indian retail sector. The report serves as an indicator of the macro-economic growth of the sector as well as a benchmark for retailers to map their growth journey against prevailing industry trends.

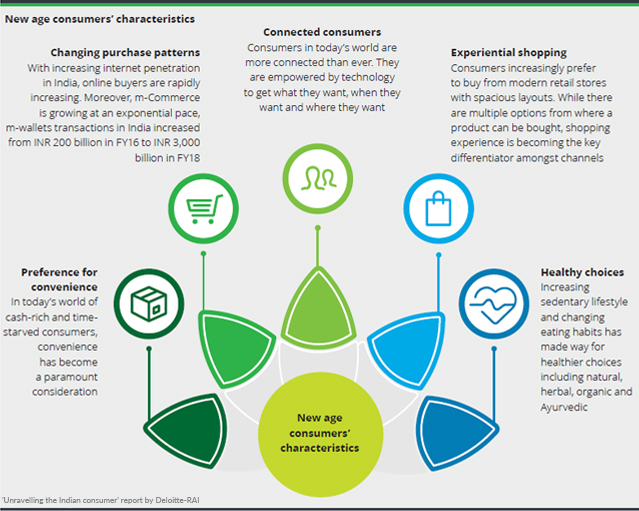

Driven by technology and modernisation, the retail sector in India is at the cusp of evolution. Disruptions throughout the value chain – sourcing, manufacturing, transportation, procurement, warehousing and inventory, distribution, marketing and advertising, selling, logistics, delivery, after sales servicing, etc. – are driving this evolution, not just in retail but throughout the broader consumer business practices.

Further, as the internet penetration in the country increases and more international retailers start operating in India, the share of organised retail market is expected to increase from ~12 percent in 2017 to 22-25 percent by 2021. This will also be driven by the growth of e-commerce market from USD 24 billion in 2017 to USD 84 billion in 2021.

Driven by technology and modernisation, the retail sector in India is at the cusp of evolution. Disruptions throughout the value chain are driving this evolution.

10 defining trends of the retail industry in India

1. Increasing importance of millennials

India has the world’s largest millennial population in absolute terms. Falling in the age group of 18-35 years, and having a population of over 440 million, millennials constitute nearly 34 percent of the country’s total population.

At 48 percent, millennials account for a major share in the workforce population.

Millennials are the first global generation of digital natives, implying that the population group was the first to witness and leverage technology and internet for shopping. Being better connected to information and being the chief wage earners in the household, millennials have significant spending power and greater access to products and services. This trend is expected to drive the consumer market in the country, leading to disruptions, especially in discretionary segments where the millennial group, in general, has a greater tendency to spend more vis-à-vis their increasing disposable incomes.

2. Rise of multichannel retail

In the current multichannel age, consumer companies in India are aligning their business strategies, especially to cater to the demands of a young and technology driven population.The advent of technology has led to consumers leveraging multiple channels for making their purchases.Internet and mobile apps have made the shopping journey of consumers convenient.

Millennials are seen to be keen on socialising and collaboration, and thus, companies need to consider proactively streamlining their two-way communication with consumers. This two-way communication has led to new model of consumer-to-business (C2B) where companies get cues to new products and services through crowdsourcing.

3. Consumer experience taking front seat

The evolving consumer markets are seen to have shifted stance from ‘bricks versus clicks’ to ‘bricks-and-clicks’. The confluence of online and offline channels is expected to drive markets, where consumer experience takes the limelight. Retail is thus evolving into a new dimension of ‘retailtainment’ or ‘retail and entertainment’.

Experiential shopping includes developments like personalised digital in-store displays and augmented reality (AR) and virtual reality (VR)- based experiences in stores.

4. Technology stepping up the retail play

Technology has been the front-runner in driving engagement and experience in consumers’ shopping journey. Apart from understanding consumers’ behavioural insights through advanced data analytics, emerging technologies such as IoT, AR and VR, Artificial Intelligence (AI), bots and drones, beacons, cloud-platforms, etc. have played a key role in enhancing consumers’ engagement more than ever.

5. Social commerce for ‘We shopping’

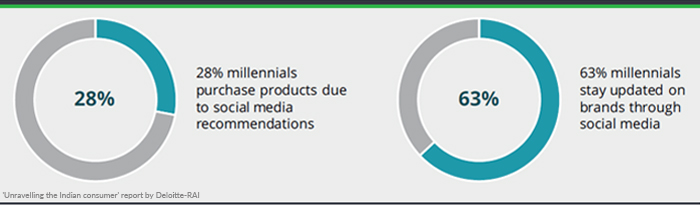

Significance of ‘S-commerce’ or social commerce has significantly increased in today’s world of connected consumers. Pictures and videos of products/brands posted by consumers on social networking sites and blogs, user experiences and stories shared on the web, ratings, reviews and recommendations posted online, etc. act as user-generated advertorial content.

This content either promotes or demotes a particular product, brand, or service amongst a specific set of people that have access to view/read the content. Social commerce is not just restricted to social network driving sales, but consists of other forms such as peer-to-peer sales platforms (community-based marketplaces), group buying (products and services offered at reduced rates if enough buyers are willing to make the purchase), user-curated shopping (where users create and share list of products/services for others to shop from), participatory commerce (where consumers become decision makers across the product value chain through voting, funding, and collaboratively designing), etc.

Since consumers can freely post information regarding their purchases or experiences on various social platforms and express their views, social media has become a great tool for companies to engage with consumers. Companies are leveraging various analytical tools and advance analytics are being to analyse the social and behavioural traits of the consumers and tweak their strategies accordingly to suit the consumers’ needs and convenience. Social sites are also used frequently to raise queries or post grievances which keeps the consumer companies on toes to respond promptly to such concerns and avoid any damage to their social rapport.

Social media platforms and online product/ service reviews form an important part of the millennials’ shopping journey as it influences their purchase decisions.

6. Personalisation for brand loyalty

Personalisation to enhance consumer engagement and to make the shopper feel privileged is increasingly becoming a norm in the industry. Consumer brands across industry segments such as food and beverage, apparel and footwear, fastmoving consumer goods (FMCG), skin and personal care, etc. are increasingly focusing on differentiating from the competition by offering more than just the product. Retailers, both offline and online, are now looking to provide customised solutions to the consumers.

7. Premiumisation

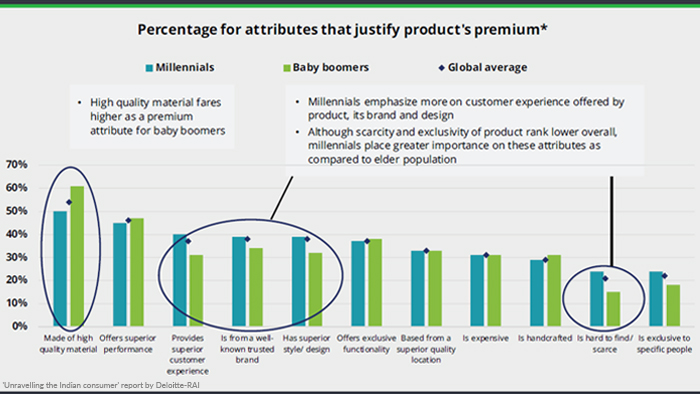

Premiumisation started as a trend in 2016 in India. Rising personal disposable incomes and changing lifestyle of consumers – giving preference to convenience – has led to this trend being adopted in full swing across sectors of consumers including retail, food and beverage, FMCG, apparel and footwear, consumer durable and electronics, etc.

With the rapid growth of millennials as the major consumer segment, the perception of product’s value and premiumisation has also altered. Consumers no longer consider a product premium based on just a high price tag. Globally, less than one-third (31 percent) of the consumers consider a product premium only because it is expensive. Thus, a clear demand for value-for-money is emerging amongst the younger consumers.

Further, as depicted in the graph below, while the attributes of perception of premium products rank similarly for baby boomers and millennials globally, the sentiment on quality and experience, product brand and design, and product scarcity or exclusivity vary significantly among the population cohorts.

8. Resonating core brand values

The rapid use of technology in the consumer market space and the rising preference for convenience are seen to be constantly challenging consumers’ brand loyalty. In the current fast-paced environment, attracting and retaining consumers to a particular brand requires significant time and effort investment. Further, consumers’ shopping traits and preference nuances would need to be analysed in depth to offer customised products and services that match their requirements. Innovation in products and bespoke service offerings such as personalised loyalty programmes, convenient after sales services, etc. could assist in attracting consumers towards a particular brand. However, to have a sustainable long-lasting relation with consumers, it may be necessary to have such brand values that resonate with the target consumer group’s core values. Imbibing such values would not only help companies build a strong brand image, but also lead to repeat consumers, implying more business.

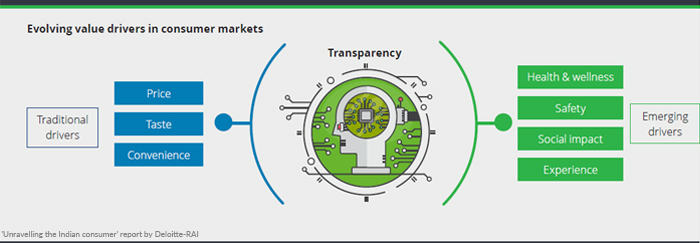

Consumers today are seen to have a new set of value drivers, which are more intrinsically linked to their core values and beliefs. Traditional drivers such as price, taste (for food products) and convenience remain critical to making buying decisions, but new drivers such as social impact, health and wellness, safety, and experience are emerging to the forefront.

Emergence of new value drivers is evident from the fact that consumers are now showing a greater interest to know and understand the story of the product. They are more willing to know the source of the raw materials and the farms/factories they have been sourced from.

Further, there is an increasing concern amongst consumers to understand the company’s wastewater and other waste recycle/reuse processes. These queries together form a story behind the journey of a product and the practices followed by the company, which in turn portrays a brand image on consumers’ minds. It is this brand image or the emotional impact that is seen forming one of the biggest reasons for consumers’ loyalty towards a particular brand. As the consumers find brands resonating same values as their own and echoing their self-expressions, they not only turn loyal with repeat visits and purchases, but also act as brand advertisers, marketing the brand through word of mouth.

9. Building a ‘Future Fit’ retail organisation

The advent of digital in retail has provided opportunities for retailers to acquire new customers, engage better with existing customers, reduce the cost of operations, and improve employee motivation along with various other benefits that have a positive influence from a revenue and margin perspective. Digital has impacted three key elements of the retail business and operating model:

- Strategy – Disruptions such as Internet of Things, Big Data Analytics, Artificial Intelligence, Predictive Analytics, Automation, Dark Analytics, Virtual and Augmented Reality and Blockchain have led to the onset of some fundamental changes in retail strategy and business models.

- Front end – The impact of digital on the front end of the retail value chain is significant and revolves around “the digital customer” experience as the pivot, with merchandising, promotions, loyalty programmes as well as point of sale (PoS) related digital solutions enriching that experience.

- Back end – Digital is driving the retail organisations to become more agile. It is impacting various facets of the back end such as supply chain, logistics and warehousing, finance, procurement and vendor management and people management.

10. Way to go forward through sustainable practices

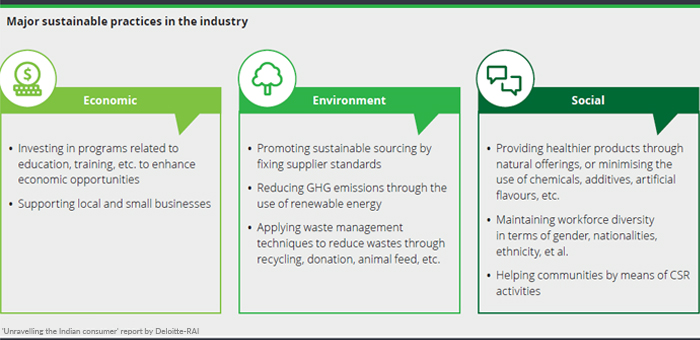

For a brand to be competitive in the long run, it needs to focus on sustaining its business practices and operations in a manner that addresses the triple bottom line (3BL) parameters – social, environmental (ecological), and financial.

There is a need for not only working towards sustainable profits for making the businesses economically viable, but also to deliver back responsibly to the society and the ecology, for running the business as a two-way win-win model. Consumer businesses are seen injecting more sustainable measures into their operations to be more competitive and create a positive brand image.

Interested in reading more articles on Retail? Check out our other articles here:

Meet the consumer of the future

To explore business opportunities, link with me by clicking on the 'Connect' button on our eBiz Card.

Disclaimer: This article is based solely on the inputs shared by the featured members. GlobalLinker does not necessarily endorse the views, opinions & facts stated by the member.

View STOrai 's profile

Other articles written by STOrai Magazine

The Art & Science of People Pleasing in Retail

13 week ago

Most read this week

Comments

Share this content

Please login or Register to join the discussion