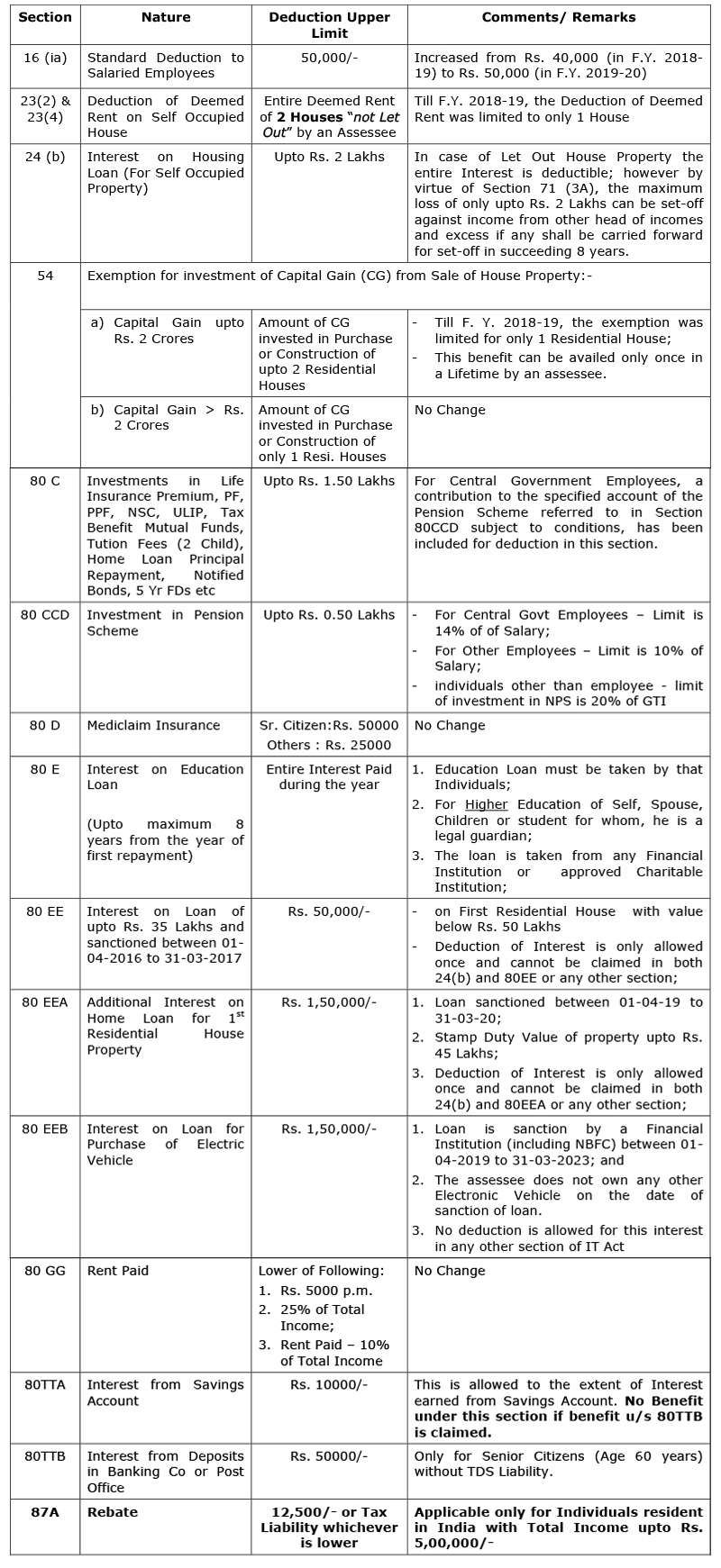

Budget Impact: Key deductions & benefits under income tax for individuals

Tax & Auditing

301 week ago — 6 min read

The Union Budget of 2019 was presented on 5 July 2019 by the first ever full-time woman Finance Minister, Smt Nirmala Sitharaman. Here is a quick review of the applicable provisions for individuals under the Income Tax Act for the financial year 2019-20 (A. Y. 2020-21). of key and selective amendments.

Key deductions & benefits under Income Tax for individuals

Surcharge

Total Income up to Rs. 50 Lakhs : NIL

Total Income > 50 Lakhs <= 1 Crore : 10%

Total Income > 1 Crore <= 2 Crore : 15%

Total Income > 2 Crores <= 5 Crore : 25%

Total Income > 5 Crores : 37%

Health & Education cess – 4% of the Income Tax & Surcharge

Late fee for delay in filing of return of income [Section 234 F]

A person who is required to furnish a return of income under section 139, fails to do so within the time prescribed in sub-section (1) of the said section, he shall pay, by way of fee, as below:

1. If his total income is up to Rs. 5 Lakhs: Rs. 1000/-

2. If his total income exceeds Rs. 5 Lakhs

- Return filled up to 31st Dec of A.Y.: Rs. 5000/-

- Return filled after 31st Dec of A. Y.: Rs. 10000/-

Note – As per Section 80AC, no deduction under chapter via (section 80a to 80 TTA) of the income tax act, 1961 shall be allowed unless the return of income is filled within due date specified u/s 139 (1) of the act.

Mandatory furnishing of return by certain persons

Currently, a person other than a company or a firm is required to furnish the return of income only if his total income exceeds the maximum amount not chargeable to tax, subject to certain exceptions. Therefore, a person entering into certain high value transactions is not necessarily required to furnish his return of income. In order to ensure that persons who enter into certain high value transactions do furnish their return of income, it is proposed to amend section 139 of the Act so as to provide that a person shall be mandatorily required to file his return of income, if during the previous year, s/he:

(i) has deposited an amount or aggregate of the amounts exceeding one crore rupees in one or more current account maintained with a banking company or a co-operative bank; or

(ii) has incurred expenditure of an amount or aggregate of the amounts exceeding two lakh rupees for himself or any other person for travel to a foreign country; or

(iii) has incurred expenditure of an amount or aggregate of the amounts exceeding one lakh rupees towards consumption of electricity; or

(iv) fulfills such other prescribed conditions, as may be prescribed.

(v) a person claiming rollover benefit of exemption from capital gains tax on investment in specified assets like house, bonds etc., under sections 54, 54B, 54D, 54EC, 54F, 54G, 54GA and 54GB of the Act, shall necessarily be required to furnish a return, if before claim of the rollover benefits, his total income is more than the maximum amount not chargeable to tax.

Also read: A list of tax benefits for startups in India

Removing difficulties of taxpayers and ease of procedures

1. Interchangeability of PAN and Aadhaar

It is proposed to provide for inter-changeability of PAN with the Aadhaar number. Accordingly. the provisions of section 139A are proposed to be amended so as to provide that-

(i) every person who is required to furnish or intimate or quote his PAN under the Act, and who, has not been allotted a PAN but possesses the Aadhaar number, may furnish or intimate or quote his Aadhaar number in lieu of PAN, and such person shall be allotted a PAN in the prescribed manner;

(ii) every person who has been allotted a PAN, and who has linked his Aadhaar number under section 139AA, may furnish or intimate or quote his Aadhaar number in lieu of a PAN.

2. Pre-filling of Income-tax Returns

Pre-filled tax returns will be made available to taxpayers which will contain details of salary income, capital gains from securities, bank interests, and dividends etc. and tax deductions. Information regarding these incomes will be collected from the concerned sources such as Banks, Stock exchanges, mutual funds, EPFO, State Registration Departments etc. This will not only significantly reduce the time taken to file a tax return but will also ensure accuracy of reporting of income and taxes.

3. Faceless e-assessment

A scheme of faceless assessment in electronic mode involving no human interface is being launched this year in a phased manner. To start with, such e-assessments shall be carried out in cases requiring verification of certain specified transactions or discrepancies. Cases selected for scrutiny shall be allocated to assessment units in a random manner and notices shall be issued electronically by a Central Cell, without disclosing the name, designation or location of the Assessing Officer. The Central Cell shall be the single point of contact between the taxpayer and the Department. This new scheme of assessment will represent a paradigm shift in the functioning of the Income Tax Department.

Also read: Decoding the Budget

Image courtesy: shutterstock.com

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

View Ritul 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion