Dubai, the hidden gem for real estate

Property & Real Estate

233 week ago — 10 min read

Background: There are several financial benefits of investing in real estate. However, the location and type of property one invests in goes a long way in determining the long-term value of such an investment.

It may be hard to guess the theme of the post from the title, but don't worry. We're here to explain. We are talking about wealth creation and growth through real estate investment…in Dubai!

Undoubtedly, real estate is considered to be one of the most profitable asset class globally. But if asked why to invest in it, how many of us could really list out the actual benefits of investing in real estate? Also, most of the readers would by now be scratching their heads and murmuring to themselves, ‘Real estate is okay, but why Dubai? And how? What’s the security of my money?’

Dubai boasts of top ranking in the world’s most luxe and prestigious locations. It is easily accessible from any part of the planet and has emerged as a thriving and flourishing business hub.

These and many other doubts, fear and myths have kept many investors in India restricted to local properties till now and hence missing on many great investment opportunities beyond the borders of India.

Although there are many good venues of wealth building through Real estate around the world, for the purpose of this post, we shall focus on Dubai. We shall delve deep into the reasons and see why one should go for Dubai and why this is the best time to invest in Dubai real estate.

So let’s get the ball rolling.

Location

Dubai boasts of its top ranking in the world’s most luxe and prestigious locations. And what a cultural melting point Dubai is - over 85% of the 4.1 million (41 Lakhs) population of Dubai is expatriate which is a marvellous display of cultural tolerance. Apart from being almost the geographical centre of the world making it easily accessible from any part of the planet, Dubai has also transformed into a thriving and flourishing financial centre and business hub of the world in a very short span of time.

Dubai is one of the seven Emirates which together form the United Arab Emirates and is also the most developed one among them. In fact, Dubai is one of the most prominent and luxurious economic centre in the entire Middle East region. Thanks to the liberal trade and strong development measures taken by the rulers in the recent years, the world has witnessed a dry, Arabian desert village transform into the most luxurious and hot tourist destination in the world.

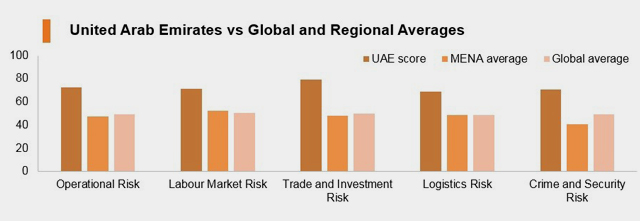

A Fitch Group Report on risks associated with doing business with UAE is shown below.

100 = Lowest risk, 0 = Highest risk | Source: Fitch Solutions

This shows how safe it is to live, work and do business in the UAE as a whole.

Let’s also have a closer look at the risk of investing in Dubai real estate market. UBS, a well renowned investment advisory firm publishes the Annual Global Real Estate Bubble Index. This index helps investors to track and compare the risk of bubbles in 24 cities around the world.

Source: UBS - Global Real Estate Bubble Index 2019

According to the latest published figures of Bubble Risk Cities in 2019 as shown above, Dubai real estate is still ‘Fairly Valued’.

Financial Perspective

With global modernisation on the horizon, Dubai’s rulers sensed that if they want to sustain in the long run, they need to diversify their economy and not just depend on their Oil reserves. With this vision they opened the doors to attract International investment into Real estate. This led to a gigantic surge in real estate and infrastructure development in the once a silent desert village. Anybody, whether a local Arabian or a foreigner can now own a property in Dubai in the designated ‘freehold’ areas with 100% ownership rights.

One of the major financial benefits of investing in Dubai property is that it can generate a steady flow of positive cash-flow for the investor in the form of ‘rental income’, which is at least double than one could earn from investment in an Indian property. This also establishes a source of passive Income which essentially represents a hands-free business. And all it takes to start this fantastic automated profitable business right from your home in India is a little financial awareness and simple math. No previous business background needed whatsoever!

Now many readers may be wondering, how on earth can they afford to buy a home in an uber posh city like Dubai? Well, a little research will make it clear that most of the home prices in Dubai have fallen sharply within the range of almost 25% - 30% from their peak rates in 2014. Today’s property rates there are almost similar to any major metropolitan city in India. As a funny fact, the current top property rate in Mumbai stands tall at INR 65,000 per square foot while in Dubai its INR 42,000 per square foot. Amazing isn’t it? Suddenly feeling the thought of buying a property - achievable? Keep that spirit alive, there’s more to come.

Another interesting fact that clearly demarcates the two markets apart is that the average home finance rates in India are in the range of 8.5 % - 9 % while in Dubai, its just 4%. What this means in simple language is that an investor can save a minimum of half of the interest paid to bank if he chooses to invest in Dubai instead of India. Mind boggling? As impossible as it may seem, this is 100% true. Oh, and did we tell you that thanks to the highly liberalised government schemes to attract investors, Dubai banks are also offering home loans to foreigners as well. High rental income from investment properties combined with cheap home finance rates makes a deadly and irresistible combo which is financially the most pragmatic decision.

Moreover, as a property investor one can also qualify to get Dubai Residency Visa (subject to certain conditions) which is really cool and exciting isn’t it?

Safety and Legal Protection

The topmost fear among investors and hesitance to invest outside Indian territory is the safety of their money and the concerns about legal protection in case of any issues, which is quite understandable. So here we will also tackle these sensitive concerns and bust some myths.

Like India Dubai also has RERA which was established quite before India. Dubai RERA acts under the aegis of Dubai Land Department and regulates all the Real estate transactions physical or otherwise across the Emirate. From our experience, laws are everywhere, even in India. The main difference lies in their enforcement. Dubai being a federal and monarchial state, nobody, and absolutely nobody can defy the laws set by the Ruler - His Highness Sheikh Mohammed Bin Rashid Al Maktoum. There is no escape or appeal once a judgement is given. The laws are super strict, and people don’t dare to break them. From an investor’s point of view, this system is beneficial as the laws are generally in favour of the buyer.

Also, the Dubai Land Department sets out high levels of transparency in their dealings. Most of the data is digitized and readily available free of cost on the department’s easy to use website. One can easily check whether a developer is registered with RERA, whether the building project is recorded in the approved projects list etc. Investors can also verify the project progress and current stage from this website.

Under the RERA regulation, the developer is mandated to open an Escrow account in which all the investors’ money related to that project must be deposited. The funds cannot be used for any other purpose except for the activities of the concerned project. This has the highest impact on protecting the investors rights.

On top of everything, RERA exercises strict monitoring and conducts periodic site inspections to ascertain project progress and verifies the transactional details too. If they find the developer defaulting on his obligations, RERA has the regulatory power to cancel the project. This is extremely rare, but when such an event occurs, RERA facilitates to liquidate the developer’s assets and disburse the money to investors. Now, this is the most prominent example and proof of the strict regulation followed by Dubai Land Department. So, investors need not worry and can be rest assured that they do have a strong legal shield against any financial misconduct by the developer.

We are sure that this post, although a long one, has cleared much of the doubts and fears in the minds of investors. If you are interested, we hope that aspiring investors can now take well informed and financially wise decisions while planning real estate investment in Dubai and see their wealth grow over time.

Also read: RERA Act - Beginning of a new era in Indian real estate sector

Image source: shutterstock.com

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Chetan BhadageWe are International Real Estate Consultants/ Advisory based out of Nashik, M.S, INDIA. Currently offering Dubai Real Estate to our esteemed Clients. We cordially invite...

Network with SMEs mentioned in this article

View Chetan 's profile

Other articles written by Chetan Bhadage

Happy project manager attributes

190 week ago

Most read this week

Comments (1)

Please login or Register to join the discussion