Insurance is not investment

Insurance

314 week ago — 5 min read

Background: Financial Advisor Usha Mallya explains how insurance and investment are two distinct functions.

If your financial planner is not saying this, then you need to look for a new one immediately. I met two such investors last week who seemed to think that insurance is investment because they ‘invested’ in insurance policies as that’s what they are being told or rather ‘sold’. It could also be because that’s what they saw their parents doing and believe is the right thing to do. So if not investment, what is insurance?

Insurance is for protection. It’s a safety net for your family in case something untoward was to happen to you. It’s a protection for your dependants in case of your death. That’s the fundamental role of an insurance policy. An investment on the other hand is meant for building wealth for yourself, your family, your future while you live. Both are mutually exclusive in many ways. So can you do without insurance? The answer is maybe, if you do not have any liabilities like loan and/or if you do not have any dependants, then maybe you don’t even need to take an insurance policy. But if you do have dependants, then it’s your duty to protect their interests and hence you should consider taking Insurance.

As a financial advisor, I would suggest you should take a Term Insurance Plan where you pay a small premium to cover yourself for any eventuality. This is what insurance is all about. You pay a premium for an eventuality. If the event doesn’t happen, you don’t get anything back. Just like in the case of vehicle insurance or health insurance. And if the event happens, your nominee gets a decent sum of money.

The best part of Term Insurance Plan is that the earlier you start, the lower you pay for the whole term. And hence, you can take a fairly large life cover that will leave your family sufficiently comfortable in case of any possible event. But here lies the problem; we believe that a term plan is a waste of money as no money comes back if we survive the term. Do we expect any money back from our vehicle insurance or home insurance then why life insurance? In order to save that small amount of money we end up paying huge premiums with the promise of getting the money back.

So here’s how it works:

A typical policy provides life cover of ten times the premium paid.

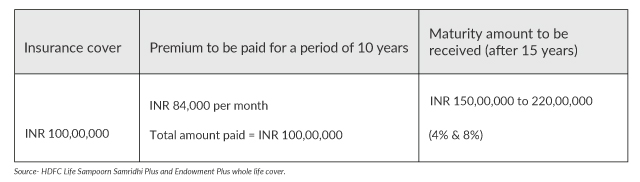

So for an insurance cover of INR 1 crore, (in case of an illustrated age of 32 years)

Traditional

Upon this payment under Whole Life Option, in addition to the benefit mentioned above, a whole life cover equal to 'sum assured' shall be available after the policy maturity. Such whole life benefit shall be payable upon the death of the life assured after the policy maturity or upon the life assured surviving up to 100 years of age, whichever is earlier.

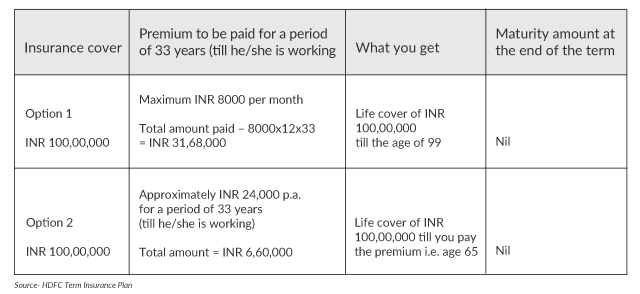

Term Insurance Plan

So the question now arises, why pay INR 8000 per month or even INR 2000 for the next 33 year and get nothing in return!

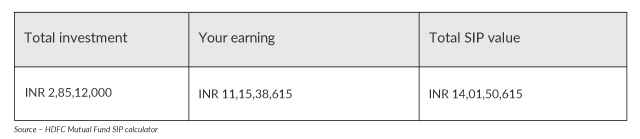

So here’s what you can do. You were ready to pay INR 80,000 per month, right? So put the remaining INR 72,000 in Equity Mutual Funds via Systematic Investment Plan, for the same period of 33 years.

And what you earn at the end of 33 years @8% (considering the same as the Insurance plan) is:

Yes! Your SIP value could be INR 14.01 crores!

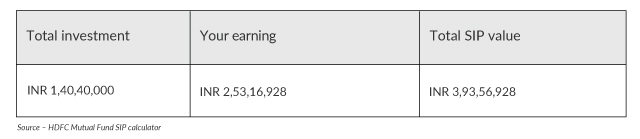

And if you don’t want to keep investing for 33 years, how about 15 years? Then your investment looks like the following:

So really, how can insurance be investment? Don’t mix the two. They are at two ends of the spectrum. Be informed, invest wisely and make your money work for you optimally.

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Usha MallyaFinancial Advisor, Financial Blogger, Conduct Financial Education workshops for Women, Financial Coach

Network with SMEs mentioned in this article

View Usha 's profile

Other articles written by Usha Mallya

Make the ‘sahi’ choice of Mutual Fund

313 week ago

Most read this week

Trending

Comments (1)

Share this content

Please login or Register to join the discussion