Interpreting the GST number (GSTIN)

GST

380 week ago — 3 min read

For the purpose of taxation, the GSTIN becomes very important for manufacturers, suppliers and traders when conducting transactions. The GSTIN is what the government uses in determining the quantum of tax after looking at corresponding invoices. For increased compliance, care must be taken to ensure that the GSTIN is used appropriately wherever necessary to ensure that taxation is done in the right manner.

As known to all, GSTIN (Goods and Services Tax Identification Number) is a 15 digit ID.

Knowing the structure of the GSTIN is important for a business for the following reasons:

- To ensure that one’s suppliers have quoted the correct GSTIN in their invoices

- To ensure that one mentions their own GSTIN correctly in invoices to customers – as input tax credit is dependent on this

- To ensure that appropriate taxes (whether IGST or CGST and SGST) are charged e.g. If the Supplier state code and the “Place of supply” state code are different, then IGST will be charged

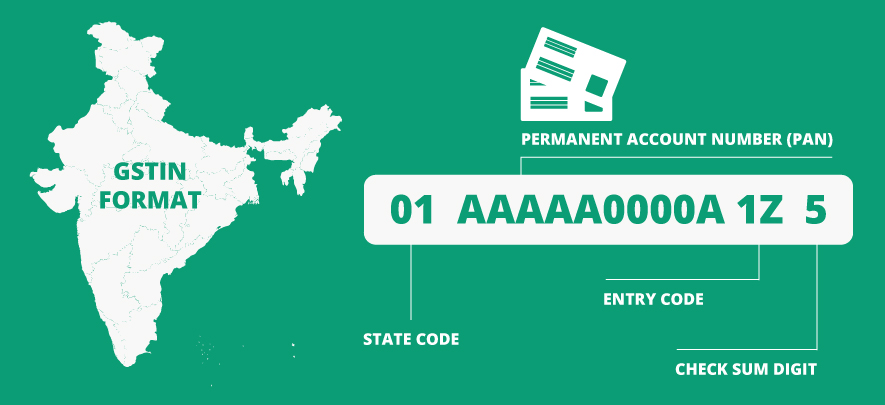

The 15 digit ID comprises of:

1. 2 digits signifying the state code: Digit 1 & 2

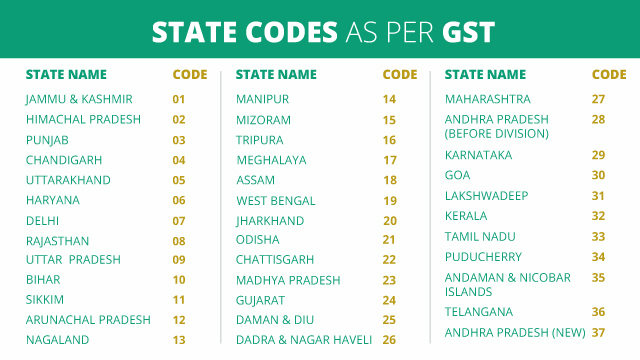

GST State Code List of India: This state code list under GST is prescribed as per the Indian Census of 2011, and is given below.

2. 10 digit PAN number: Digits 3 – 12 represent the PAN of the entity, so that a nexus can be established between the GST and the PAN database.

3. 1 digit signifying number of registrations: Digit 13 is entity code, which signifies number of registration that an entity has taken within a particular state. It would be pertinent to note that a new registration in a different state will have GSTIN starting with a different state code. A registered person with single registration within a State would have number 1 as 13th digit of the GSTIN. If the same registered person gets a second registration for a second business in the same State, the 13th digit of GSTIN assigned to this second entity would be 2 and so on.

4. 2 digits having default and checksum values: Last two digits are for the purpose of check digit.

To explore business opportunities, link with me by clicking on the 'Invite' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Ravi Haresh KariyaEbizFiling.com is a motivated and progressive firm managed by like-minded people. It helps a variety of small, medium and large businesses to cater to all compliance requirements...

View Ravi 's profile

Other articles written by Ravi Kariya

How to register an LLP in India?

247 week ago

How to register a Proprietorship Company in India?

247 week ago

How to register Private Limited Company in India

247 week ago

Most read this week

Trending

Comments

Share this content

Please login or Register to join the discussion